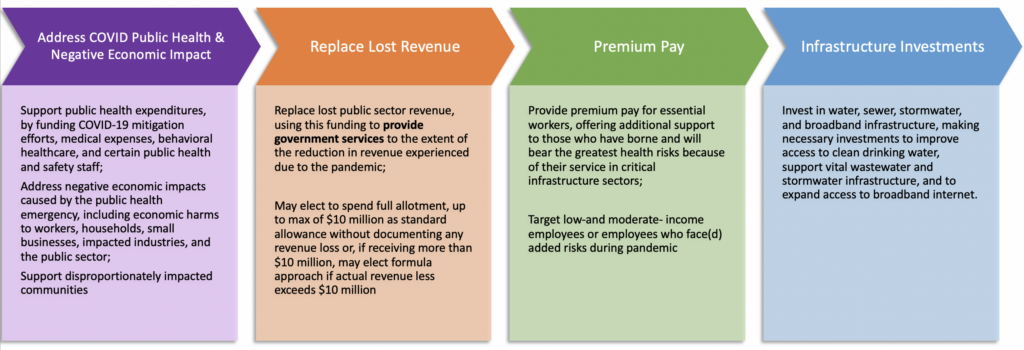

As detailed in previous posts, the American Rescue Plan Act of 2021 Coronavirus State and Local Fiscal Recovery Funds (ARP/CSLFRF) allows local governments to spend their allocations on eligible projects within four major expenditure groupings:

- Addressing the COVID-19 public health emergency and its negative economic impacts

- Premium pay for eligible workers performing essential work during the pandemic (see blog post on premium pay for local government employees)

- Necessary water, wastewater, and broadband infrastructure

- Revenue replacement for lost revenue growth

There are detailed Expenditure Categories (ECs), which are more like subcategories, within each of these four broader categories. See the Appendix to US Treasury’s Compliance and Reporting Guidance for the list of ECs. Each project must be associated with one, and only one, EC. A project is a group of related expenditures. Projects in this context may include expenditures for operational, administrative, programmatic, and capital purposes.

Many local governments will spend all, and most local governments will spend at least a portion, of their ARP/CSLFRF funds in the revenue replacement category (EC 6.1 or 6.2). A local government may spend up to $10 million or its entire allotment of ARP/CSLFRF funds, whichever is lower, in this category, without having to demonstrate any actual lost revenue growth. Yes, you read that correctly. A local government may expend its ARP/CSLFRF allocation, up to a maximum of $10 million, in the revenue replacement category even if it did not experience any revenue loss due to the pandemic. (See blog post on the standard allowance.) Local governments with a total ARP/CSLFRF allocation over $10 million may spend more than $10 million as revenue replacement if a detailed formula reveals more than $10 million in actual lost revenue growth due to the pandemic. Otherwise, they are capped at $10 million under what is known as the standard allowance.

The benefit of the revenue replacement category is that it allows a local government to spend its ARP/CSLFRF funds for almost any purpose authorized by state law, with fewer compliance requirements and more streamlined reporting. As indicated below, there are a few expenditures that are prohibited by the ARP/CSLFRF. Aside from these prohibited expenditures, a local government is generally free to spend its ARP/CSLFRF funds as it would its other unrestricted revenue sources.

This blog post details eligible expenditures and compliance requirements for revenue replacement. It highlights recent changes by US Treasury (as of July 2022) to further reduce the compliance burden in this category. It then provides a specific roadmap to making revenue replacement expenditures, along with a downloadable checklist. (Many of you will want to skip directly to that section.)

Revenue Replacement Expenditures

Allowable Expenditures

Revenue replacement ARP/CSLFRF funds may be spent on the provision of government services. US Treasury does not define “government services,” but provides several non-exclusive examples:

In US Treasury’s Final Rule Supplement, government services include: “maintenance or pay-go funded building of infrastructure, including roads; modernization of cybersecurity, including hardware, software, and protection of critical infrastructure; health services; environmental remediation; school or educational services; and the provision of police, fire, and other public safety services.”

In US Treasury’s Final Rule Overview, it states: “[g]overnment services generally include any service traditionally provided by a government, unless Treasury has stated otherwise. Here are some common examples, although this list is not exhaustive: Construction of schools and hospitals; Road building and maintenance, and other infrastructure; Health services; General government administration, staff, and administrative facilities; Environmental remediation; [and] Provision of police, fire, and other public safety services (including purchase of fire trucks and police vehicles).”

And in US Treasury’s FAQs on the Final Rule, the answer to Q 3.2 states: “Treasury is clarifying here that under the final rule, payroll for government employees, contracts, grants, supplies and equipment, rent, and the many other costs that governments typically bear to provide services are costs that could comprise the costs of government services, and are eligible uses of funds.”

As these examples attest, the authority to expend ARP/CSLFRF funds in the revenue replacement category is very broad. It encompasses almost anything a local government has state law authority to undertake, including general fund and enterprise fund expenditures, operating and capital expenditures, administrative costs, salaries and benefits, and other internal costs, and external contracts for projects and services. And the ARP/CSLFRF allows a local government to reimburse itself for eligible expenditures incurred all the way back to March 3, 2021.

Prohibited Expenditures

There are certain prohibited expenditures, though. ARP/CSLFRF funds, even revenue replacement ARP/CSLFRF funds, MAY NOT be spent on (1) extra pension fund contributions; (2) borrowing costs or debt service (loan) payments; (3) financial reserves / rainy day fund contributions; (4) litigation costs, including settlements / judgements / consent decrees; (5) expenditures that undermine or discourage compliance with Centers for Disease Control (CDC) guidelines; (6) expenditures that violate federal conflict of interest provisions; and (7) expenditures that violate state law or other federal laws and regulations, including applicable Uniform Guidance requirements.

Revenue Replacement Compliance Requirements

Although the compliance and reporting mandates for revenue replacement are more streamlined than those that apply to the other ARP/CSLFRF categories, there are still some federal substantive and process requirements (in addition to applicable state law requirements). Specifically, a local government must comply with the ARP/CSLFRF Award Terms and Conditions, specified Uniform Guidance provisions, and any applicable state law provisions.

Award Terms and Conditions

All ARP/CSLFRF expenditures, including revenue replacement expenditures, are subject to the grant award terms and conditions. They are detailed here. The major provisions are summarized as follows:

Eligible Use. A local government may only use ARP/CSLFRF funds for an eligible use, as defined by the ARP/CSLFRF Final Rule. As detailed above, an eligible use in the revenue replacement category is any expenditure a local government has state law authority to make, except as specifically prohibited by the ARP/CSLFRF Final Rule (see prohibited expenditures above).

Period of Performance. A local government may only use ARP/CSLFRF funds for eligible costs incurred from March 3, 2021 through December 31, 2024. And all ARP/CSLFRF monies must be expended by December 31, 2026. A cost is incurred when it is legally obligated and expended when the amount is due for payment. Reimbursement expenditures are allowed as long as the cost was incurred for an eligible project on after March 3, 2021.

Reporting. A local government must comply with reporting obligations established by US Treasury for the ARP/CSLFRF. The reporting requirements are detailed here.

Maintenance of and Access to Records. A local government must maintain records and financial documents sufficient to evidence compliance with the ARP/CSLFRF and all applicable regulations. The US Treasury Office of Inspector General and the Government Accountability Office, or their authorized representatives, have the right of access to records (electronic and otherwise) to conduct audits or other investigations. All ARP/CSLFRF records must be maintained for a period of five (5) years after all funds have been expended or returned to US Treasury, whichever is later.

Conflicts of Interest. A local government must maintain a conflict-of-interest policy consistent with 2 C.F.R. § 200.318(c). The local government must disclose in writing to US Treasury any potential conflict of interest affecting the awarded funds in accordance with 2 C.F.R. § 200.112.

Compliance with Applicable Laws and Regulations. A local government must comply with the requirements of ARP/CSLFRF, regulations adopted by US Treasury pursuant to the ARP/CSLFRF, and other applicable guidance issued by US Treasury. It also must comply with all other applicable federal statutes, regulations, and executive orders. Federal regulations applicable to this award include, without limitation, the following:

-

- Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, 2 C.F.R. Part 200, other than such provisions as Treasury may determine are inapplicable to this Award and subject to such exceptions as may be otherwise provided by Treasury. Subpart F – Audit Requirements of the Uniform Guidance, implementing the Single Audit Act, shall apply to this award. As detailed below, US Treasury has exempted revenue replacement expenditures from some of these requirements.

- Universal Identifier and System for Award Management (SAM), 2 C.F.R. Part 25, pursuant to which the award term set forth in Appendix A to 2 C.F.R. Part 25 is hereby incorporated by reference.

- Recipient Integrity and Performance Matters, pursuant to which the award term set forth in 2 C.F.R. Part 200, Appendix XII to Part 200 is hereby incorporated by reference.

- Governmentwide Requirements for Drug-Free Workplace, 31 C.F.R. Part 20.

- New Restrictions on Lobbying, 31 C.F.R. Part 21.

- Uniform Relocation Assistance and Real Property Acquisitions Act of 1970 (42 U.S.C. §§ 4601-4655) and implementing regulations.

- Generally applicable federal environmental laws and regulations.

Civil Rights Compliance. A local government must assure compliance with federal civil rights laws.

Hatch Act. A local government must comply, as applicable, with requirements of the Hatch Act (5 U.S.C. §§ 1501-1508 and 7324-7328), which limit certain political activities of State or local government employees whose principal employment is in connection with an activity financed in whole or in part by this federal assistance.

Protections for Whistleblowers. A local government must provide whistleblower protections related to the grant in accordance with 41 U.S.C. § 4712.

Uniform Guidance Provisions

As part of the ARP/CSLFRF Award Terms and Conditions, a recipient local government must follow the federal Uniform Guidance in implementing the grant. The Uniform Guidance, 2 CFR 200, is a set of federal regulations that apply to federal awards. The Assistance Listing: Coronavirus State and Local Fiscal Recovery Funds specifies the Uniform Guidance (UG) provisions that apply to the ARP/CSLFRF. However, as of July 27, 2022, US Treasury has exempted revenue replacement expenditures from some of the most challenging of these requirements. A local government must only follow the specific UG regulations identified in Final Rule FAQ 13.15 for revenue replacement expenditures. They are:

- Subpart A, Acronyms and Definitions

- Subpart B, General provisions

- Subpart C, Pre-Federal Award Requirements and Contents of Federal Awards (except 2 CFR 200.204, .205, .210, and .213)

- Subpart D, Post Federal; Award Requirements (But only the provisions listed below)

- 300 Statutory and national policy requirements.

• 200.302 Financial management.

• 200.303 Internal controls.

• 200.328 Financial reporting.

• 200.329 Monitoring and reporting program performance.

• Record Retention and Access (2 C.F.R. 200.334 – 200.338) - 334 Retention requirements for records.

- 335 Requests for transfer of records.

- 336 Methods for collection, transmission, and storage of information.

- 337 Access to records.

- 338 Restrictions on public access to records.

- 339 Remedies for noncompliance.

- 340 Termination.

- 341 Notification of termination requirement.

- 342 Opportunities to object, hearings, and appeals.

- 343 Effects of suspension and termination.

- 200.344 Closeout.

- 200.345 Post-closeout adjustments and continuing responsibilities.

- 200.346 Collection of amounts due.

- 300 Statutory and national policy requirements.

- Subpart E, Cost Principles (But only 200.400(a)-(c) and (e); 200.403(a), (c), (d), (g), and (h); 200.404(e))

- Subpart F, Audit Requirements (Unless eligible for alternative compliance engagement)

- 2 CFR Part 25 (Universal Identifier & System for Award Management)

As a practical matter this means that revenue replacement expenditures are NOT subject to federal procurement and contracting requirements, program income, property management, subawards, and Federal Funding Accountability and Transparency Act (FFATA) reporting. And revenue replacement expenditures are subject to a more limited allowable cost/cost principles review. Although it appears that a local government is still subject to many UG provisions, the good news is that they are relatively straightforward to implement.

State Law Provisions

A local government must also follow any state law provisions applicable to specific projects. For example, if revenue replacement funds are used for a construction project, state law bidding and contracting laws apply, even though federal provisions do not.

Roadmap for Revenue Replacement Expenditures

Putting this all together, the following provides a step-by-step guide to making ARP/CSLFRF revenue replacement expenditures. (And here is a .pdf version to download for your convenience.)

STEP 1: ESTABLISH FINANCIAL MANAGEMENT SYSTEM AND ADOPT WRITTEN INTERNAL CONTROLS

Before making any specific revenue replacement expenditures, a local government must establish its general compliance framework. That includes the following:

Set up basic financial administration. A local government must have a financial management system that is sufficient to allow it to complete all necessary reporting requirements related to the ARP/CSLFRF award. It does not have to be a sophisticated system. For many local governments a simple spreadsheet will suffice. At a minimum, a local government must track obligations and expenditures of ARP/CSLFRF funds by project and include real-time comparisons to budgeted amounts for those projects. If a local government’s current financial management system does not allow for this level of tracking, staff may use one of these Excel Tracking Templates (Template 1 and Template 2).

Adopt and implement written internal controls. Additionally, a local government must adopt and implement a written set of internal controls related to its financial transactions. The nature of these controls will vary based on the size of the unit and its staffing capacity, but there are some minimum requirements. A local government should generally conform its internal controls to those that apply to federal agencies through what is known as the federal “Green Book” or the COSO framework. That does not mean that a local government must adopt all the specific controls that apply to federal agencies; rather, it should simply follow the same general framework for its own controls. The controls fall within five main categories. A local government’s written internal controls identify specific actions/procedures within each of these categories. The five categories are:

-

-

- Control Environment. Include provisions related to the role of the board in setting the tone for full compliance by all local government employees and officials and the board’s commitment to integrity and ethics. Also include provisions related to how the board enforces accountability—periodic reporting, internal audits, audit committees, consequences for noncompliance, etc.

- Risk Assessments. Include provisions about how the local government identifies and analyzes risk of fraud, mistake, or other misappropriation. Who performs this function? What is involved in risk assessments? How are they documented? How often are risk assessments performed? What changes impact risk?

- Control Activities. Include provisions about activities that address potential risks. This section should include the specific controls that the local government has adopted, such as segregating duties for financial transactions, processes and oversight related to cash drawers, processes for receiving and reconciling revenues, rotating duties for financial transactions, controls over access to technology, cash management, deposits, and disbursement controls, etc. It should specify who performs what duties and who is responsible for supervision/oversight.

- Communication/Training. Include provisions related to how personnel are informed and trained on appropriate controls and how any changes are communicated.

- Monitoring Activities. Include provisions related to how the local government will monitor all financial activities to ensure proper compliance with controls and to ensure controls are effective. Who performs this function? How is it documented? This section should also detail what happens when deficiencies are detected and identify specific consequences for noncompliance.

-

The North Carolina Department of State Treasurer has a helpful guide on specific internal control considerations and processes for smaller units.

STEP 2: ADOPT AND IMPLEMENT GENERAL COMPLIANCE POLICIES

A local government must adopt and implement the following policies for all ARP/CSLFRF expenditures, including those in the revenue replacement category. I have included links to sample policies for each that a local government may use as templates.

Records Retention. This policy supplements a local government’s regular records retention policy to establish procedures to retain all ARP/CSLFRF-related information for at least 5 years after all grant funds are expended or returned to US Treasury. (Sample policy here.)

Eligible Use. This is a simple policy that indicates allowable and unallowable projects, based on the expenditure categories in the ARP/CSLFRF Final Rule. It requires a local government to identify staff to document and review ARP/CSLFRF expenditures. That documentation must be retained according to the record retention requirements. (Sample policy here.)

Allowable Cost. This is policy requires a local government to perform a general review of each cost item to ensure it is allocable, reasonable, consistently treated, and properly documented. (Sample policy here.) As noted above, the specific cost item regulations in the UG do not apply to revenue replacement expenditures. That section of the allowable cost policy will not be triggered for expenditures in this category.

Civil Rights Compliance. This policy reaffirms the local government’s commitment to compliance with federal civil rights laws and establishes processes for reporting potential violations and tracking complaints and resolutions. (Sample policy here.)

Conflict of Interest. The UG requires recipients and subrecipients of federal financial assistance to maintain written standards of conduct covering conflicts of interest and governing the actions of its employees engaged in the selection, award, and administration of contracts. (Sample policy here.)

STEP 3: IDENTIFY ELIGIBLE PROJECT

A local government may use revenue replacement ARP/CSLFRF for any purpose authorized by state law, except for the specific prohibited items listed above. Examples include paying salaries and benefits of local government employees, contracting with other local governments or nonprofits to provide community programs or services, purchasing real property, supplies, and equipment, and contracting for design, construction, repair, or renovation work. A local government should identify the purpose, scope, and estimated cost of the project. It then must identify state law authority and any state law process requirements. Finally, it must ensure the project is not on the prohibited list (detailed above). Recall that ARP/CSLFRF funds also may be used to reimburse a local government for a prior eligible project, as long as the costs were incurred on or after March 3, 2021.

STEP 4: DOCUMENT COMPLIANCE WITH REQUIRED POLICIES

The implementation of the UG policies related to a revenue replacement project/expenditure is straightforward. A local government must do the following:

Document eligibility determination and basic allowable cost review, according to procedures in these two policies: eligible use policy and allowable cost policy. This can be accomplished with this Eligibility and Allowable Cost Documentation Template or through a similar document created by the local government.

Determine and address any conflicts of interest, according to the local government’s conflict of interest policy that incorporates both state and federal requirements. Note that internal expenditures on salaries and benefits will not trigger conflict of interest issues, but external agreements funded with revenue replacement funds might.

STEP 5: FOLLOW STATE LAW BUDGETING

ARP/CSLFRF funds must be properly budgeted before they can be obligated and expended. See G.S. 159-8. I recommend budgeting ARP/CSLFRF funds in a grant project ordinance, pursuant to G.S. 159-13.2. Here is a budget template and this blog post details different budgeting and accounting options for different types of revenue replacement expenditures.

STEP 6: ENTER INTO OBLIGATIONS AND MAKE DISBURSEMENTS

A local government must follow state law processes to incur obligations and make disbursements. An obligation happens when a local government makes a legal commitment to pay money to another. Examples include issuing POs to vendors, using a credit card or p-card to purchase goods or services, and executing a contract for services or construction. Before incurring an obligation, a local government must follow the preaudit process. See G.S. 159-28. Once the goods are delivered or services are performed, an expenditure occurs, and a local government performs a disbursement process before paying the invoice or bill. Id. As part of that disbursement process, finance staff must ensure that there is proper documentation of performance by the other party to the agreement and that the amounts requested are due and owing.

STEP 7: COMPLETE REQUIRED US TREASURY REPORTS

The ARP/CSLFRF requires a local government to complete periodic reports to US Treasury. Most local governments must complete a yearly Project and Expenditure Report. Some will complete this report quarterly and a few (the largest local governments) also will complete a yearly Recovery Plan Performance Report. A schedule of reporting requirements and deadlines is here. For local governments that expend all their ARP/CSLFRF funds in the revenue replacement category, completing the Project and Expenditure Report is easy. All revenue replacement expenditures may be reported as a single project with a brief narrative to outline the specifics.

STEP 8: RETAIN DOCUMENTATION ACCORDING TO ARP/CSLFRF-SPECIFIC RETENTION POLICY

A local government must retain all policies, budgets, contracts, documentation, and other records justifying its ARP/CSLFRF expenditures according to its ARP/CSLFRF-specific record retention policy. (Reminder that all documentation must be retained for at least five years after all grant funds are expended or returned to US Treasury.) For example, if a local government expends its revenue replacement funds on salaries and benefits, it must retain general financial records tracking the obligations and disbursements, payroll records, the grant project ordinance appropriation(s) and any amendments, special revenue fund records and any journal entries, the eligibility determination documentation, and the allowable cost review documentation for the required retention period. (Sample documentation form for both eligibility determination and allowable cost review here.)

STEP 9: PREPARE FOR AUDIT

All local governments are subject to a yearly independent financial audit, pursuant to G.S. 159-34. Expenditure of federal funds, though, may trigger greater audit scrutiny. As detailed in Rebecca Badgett’s post, if a local government expends $100,000 or more in combined state and federal funds in any fiscal year, it also triggers a Yellow Book audit. And if a local government expends $750,000 or more of federal funds in any fiscal year, it also triggers a federal Single Audit, unless the local government qualifies for the alternative compliance engagement that applies to the ARP/CSLFRF program. If a local government triggers the Single Audit, it must follow UG procurement requirements (as detailed in Rebecca’s post) to select and contract with its auditor. These requirements still apply even if all expenditures are from Revenue Replacement ARP/CSLFRF funds and even if the audit contract is paid for with Revenue Replacement funds or non-grant revenue sources.