What’s the only type of property that can change from real property to personal property and back again in the blink of an eye? The answer is mobile homes, the species of property that produces more headaches per tax dollar than any other.

Actually, the more specific answer is manufactured homes, which are a subset of mobile homes. All manufactured homes are mobile homes but not all mobile homes are manufactured homes. Some but not all manufactured homes are real property, a distinction that used to depend on whether the home was a single-wide or a double-wide. That distinction is no longer relevant to the real/personal property classification, but lots of folks think it still is. Some single-wides and double-wides that are not real property can transform into real property through the stroke of a pen. Regardless of whether they are real or personal property, all mobile homes, which means all manufactured homes, are subject to moving permit requirements that may require payment of taxes on property that the current owner of the mobile home never owned.

Now you see where the headaches come from.

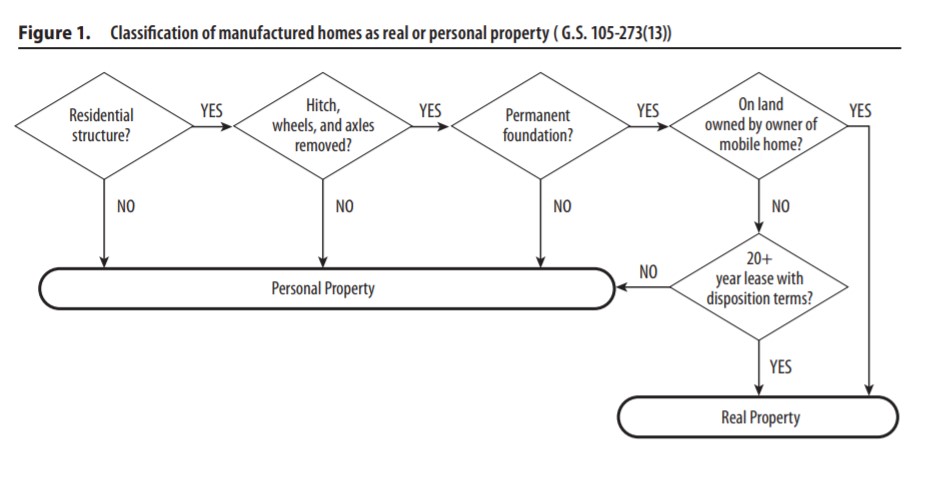

I’ve done my best to alleviate these headaches with the publication of Property Tax Bulletin #157. That bulletin covers all of the issues involved with taxing mobile homes, including this graphical representation of the real/personal property classification process.

As you can see, none of these criteria focuses on whether the mobile home is a single-wide or a double-wide. Prior to 2003, the definition of real property turned in part on whether the mobile home in question was “multi-section,” hence the practice in many counties for many years of listing double-wides as real property and single-wides as personal property. Anecdotal evidence suggests that this practice lingers in some counties.

Many mobile homes fail the real property test because of the final requirement concerning placement of the home on land owned by the owner of the home. (A long-term lease can also satisfy this requirement, but that is rarely the case.) Consider the many individually owned mobile homes that are located on leased land in mobile home parks. All of those homes should be classified as personal property regardless of their size or construction.

The fact that the owner of the land is related to the owner of the mobile home is not sufficient. If the owners are not identical, the mobile home cannot be classified as real property. This requirement means that a mobile owned by Husband and located on land owned as tenants by the entirety by Husband and Wife must be classified as personal property. The same would be true of a mobile home owned by the sole shareholder of a corporation that owns the land on which the home sits.

A mobile home can transform from real to personal property or vice versa with the stroke of a pen despite that fact that the home undergoes no physical change. If my brother owns a mobile home that satisfies all of the physical requirements for real property but is located on my land, that mobile home must be classified as personal property. If my brother sells me the mobile home, the minute that transfer is properly documented that mobile home should transform into real property.

Why do we care so much about the real/personal property classification? Mostly because of its effect on collection remedies, although it may also affect the appraisal process.

Taxes on a mobile home that is properly classified as real property are a lien on the underlying land, meaning the tax collector can turn to foreclosure if the taxes aren’t paid. If a mobile home is classified as personal property because the home is owned by someone other than the owner of the underlying land, then foreclosure on that land is not an option. The tax collector can always seize and sell the mobile home itself for delinquent taxes, but many mobile homes are in such poor condition that they would attract few potential purchasers. And those that might fetch good prices sometimes disappear in the middle of the night, never to be seen again.

Mobile homes aren’t supposed to disappear in the middle of the night, of course. A taxpayer is required to obtain a moving permit from the tax collector before removing a home from its current location. To obtain a permit, the taxpayer must pay “all taxes due to be paid by the owner.” This requirement is generally interpreted to mean that the party applying for a permit must pay all taxes owed on the home, even if those taxes were the responsibility of the former owner. Some jurisdictions interpret that provision to require payment of all taxes owed by the previous owner of the home even if those taxes are owed on property other than the mobile home itself.

The most frequent violators of the moving permit requirement are often financing companies who repossess mobile homes and remove them from the county without notice to the tax collector. Outside of a criminal misdemeanor provision that I’m not sure has ever been enforced, the Machinery Act provides little recourse for the tax collector in such a situation. The party who illegally moves a mobile home is not made subject to enforced collection remedies for taxes on the home incurred by a prior owner. Absent a change in the law, the tax collector should pursue all available collections remedies such as attachment and garnishment before several years of taxes build up and the mobile home becomes a flight risk.